- Written & Reviewed by Jeremy

- Published

- Last Updated Sep 12, 2025

You’ve probably heard about SEO search engine optimization and its importance for businesses that want to use the internet to reach prospective clients.

In addition to “regular” search engine optimization, there’s a sub-discipline called “local SEO” that’s important for businesses that only operate in their local area (as opposed to an e-commerce business that can sell products to anyone in the country), which includes your financial advisor business.

While many of the best practices that fall under the local SEO umbrella are also part of any effective SEO strategy for financial advisors, there are several that are specific to location-based businesses that need to be followed to help increase the chances of them being seen in local search results.

Most importantly, these will be high-intent searches such as “financial advisor near me” that have a high likelihood of converting into at least a phone call since they’re explicitly looking for a financial advisor.

These are several SEO factors that search engines use to determine which websites show up on the SERP (Search Engine Results Page). Read this article to learn some of the local SEO best practices that are important for any financial advisory practice to follow so that their website gets shown to these high-intent prospects:

What is Local SEO for Financial Advisors?

Local (Search Engine Optimization) SEO for financial advisors is the process of optimising your website and online presence so that it appears in local search results on Google and other search engines. Unlike traditional SEO, which casts a wide net, local SEO focuses on improving visibility for location-based searches such as:

- “Financial advisor in [city name]”

- “Retirement planner near me”

- “Wealth management [town name]”

Why Local SEO Matters for Financial Advisors

- High-intent clients – People searching with local keywords are ready to act. They’re not just browsing; they’re actively seeking an advisor in their area.

- Competitive advantage – Many advisors still rely on word-of-mouth referrals. By leveraging local SEO, you can stand out in search results and capture clients your competitors overlook.

- Trust and credibility – Appearing in Google’s “local pack” (the map section of search results) signals authority and builds trust with prospective clients.

- Cost-effective lead generation – Unlike paid ads, optimised local SEO can generate consistent, organic leads without ongoing ad spend.

In short, local SEO turns your website and Google profile into a 24/7 lead-generation tool for your practice.

Key Elements of Local SEO for Financial Advisors

1. Google Business Profile Optimisation

Your Google Business Profile (GBP) is the foundation of local SEO for financial advisor. It determines how your business appears on Google Search and Maps when someone searches “financial advisor near me.”

Here’s how to optimise it properly:

- Claim and verify your profile to unlock full control of your business listing.

- Use your exact business name (avoid keyword stuffing, e.g., don’t use “Best Dallas Financial Advisor Firm”).

- Add core business info: address, phone number, website, and office hours. Make sure this matches what’s listed on your website.

- Select accurate categories like Financial Planner, Wealth Management Service, or Investment Service.

- Upload professional images of your team, office, and branding. Google listings with photos receive more engagement.

- Post regular updates — share blogs, announcements, community events, or financial tips to stay active.

A fully optimised GBP not only boosts your local search ranking but also encourages prospects to call, request directions, or book appointments directly from search results.

2. Local Keyword Strategy

SEO success starts with choosing the right keywords. For financial advisors, this means targeting phrases your ideal clients search, combined with your location.

How to research keywords:

- Use tools like Google Keyword Planner, SEMrush, or Ahrefs to find keywords with strong local intent.

- Look at People Also Ask (PAA) questions in Google to identify common client queries.

- Check competitor websites to see what location-based terms they rank for.

Once identified, integrate these keywords naturally into:

- Website content (service pages, blog posts).

- Title tags & meta descriptions.

- Your Google Business Profile.

- Headers and alt text on images.

Tip: Local relevance matters more than high volume. Targeting “Retirement planner Denver” may bring fewer searches but much higher-quality leads than a generic term like “retirement planner.”

3. On-Page SEO for Local Searches

Once you’ve identified the right keywords, ensure your website communicates clearly to both Google and potential clients where you operate and what you do.

- Title Tags & Meta Descriptions: Example → “Retirement Planning Services in Denver | [Firm Name].” These appear in search results and can determine whether someone clicks.

- Headers (H1, H2, H3): Include local keywords naturally. Example: “Why Denver Residents Need a Local Retirement Planner.”

- NAP Consistency: Display your Name, Address, and Phone number on every page (often in the footer). This should exactly match your Google profile.

- Location-Specific Landing Pages: If you serve multiple cities, create individual pages like “Financial Planning in Austin” and “Financial Planning in Houston.”

This makes your business location signals crystal clear and helps you rank higher in both organic search results and map packs.

4. Local Citations & Directories

Citations are online mentions of your business info (NAP) on other websites. They act like “trust signals” for search engines.

Where to build citations:

- General directories: Yelp, Yellow Pages, Bing Places.

- Finance-specific directories: NAPFA, CFP Board, FPA.

- Local directories: Chamber of Commerce websites, city-specific business listings.

Tips:

- Ensure your NAP is 100% consistent everywhere. Even small differences (e.g., “Street” vs. “St.”) can hurt local rankings.

- Aim to get backlinks from local sources by sponsoring events, partnering with local charities, or writing guest columns in community publications.

5. Online Reviews & Reputation Management

For financial advisors, trust is everything. Reviews not only influence search rankings but also reassure potential clients that you’re credible.

How to manage reviews effectively:

- Request reviews: After a successful client meeting, politely ask them to leave a Google review.

- Respond to all reviews: Thank clients for positive ones, and handle negative ones professionally to show transparency.

- Showcase testimonials on your website to build credibility.

- Avoid shortcuts never buy fake reviews. Authenticity builds long-term trust.

6. Content Marketing with a Local Focus

Content is still the backbone of SEO. For financial advisors, adding a local spin makes your content even more effective.

Ideas for localised content:

- Blog posts like “How Retirement Planning Differs in Texas” or “Estate Planning Strategies for New Yorkers.”

- Case studies of local client success stories (with permission).

- Updates on state-specific tax laws or market trends.

- Recaps of financial seminars or workshops you’ve hosted in your city.

Consistently publishing location-focused content positions you as the go-to advisor in your region while boosting visibility for geographic searches.

7. Mobile & Voice Search Optimisation

Over 60% of local searches happen on mobile devices, and voice search is becoming increasingly common (e.g., “Alexa, find a financial advisor near me”).

To optimise:

- Ensure your website is mobile-friendly, responsive, and loads in under 3 seconds.

- Use conversational keywords like “How do I find a financial advisor in Dallas?”

- Optimise for “near me” searches by maintaining updated business info across directories.

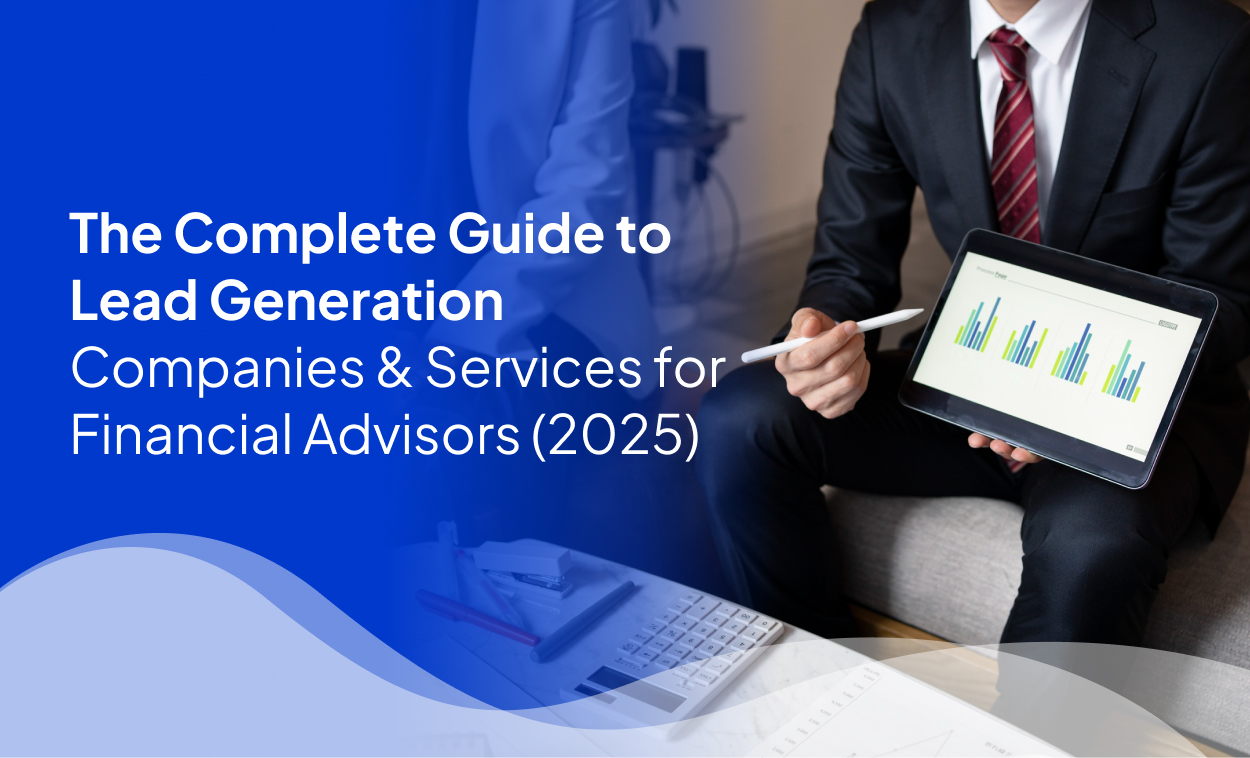

Measuring the Success of Local SEO

SEO is not a one-time project it’s an ongoing strategy. You need to measure progress regularly to see what’s working.

Tools to use:

- Google Analytics: Track local search traffic, leads, and conversions.

- Google Search Console: Monitor keyword rankings and performance of location-based searches.

- GBP Insights: See how many people called, visited your website, or requested directions from your listing.

- Rank tracking tools like SEMrush or BrightLocal to track your local keyword rankings over time.

Review these metrics monthly and adjust your strategy to keep improving visibility.

Action Plan: How Financial Advisors Can Get Started

To put this into action today:

- Claim and fully optimise your Google Business Profile.

- Research and add local keywords to your website.

- Ensure NAP consistency across directories.

- Start requesting and responding to reviews.

- Publish location-specific blog content regularly.

- Track results with analytics tools and refine strategy.

Winning local clients starts with showing up where they’re searching. At Revenx, we deliver SEO for financial planners that dominates local results and puts you in front of prospects at the right moment. We don’t stop there our strategies blend location-based visibility with Google Ads for insurance agents, ensuring you capture both organic and paid traffic. To nurture these new connections, we also implement email marketing for financial advisors, helping you turn inquiries into lifelong client relationships. With Revenx, your local presence becomes your competitive edge.

Final Thoughts

For financial advisors, local SEO is one of the most effective ways to attract high-quality clients in your area. While national SEO can be competitive and resource-intensive, local SEO allows you to position yourself as the go-to advisor for people searching nearby.

In a crowded marketplace, being visible locally can make the difference between a prospect choosing you or a competitor. Start implementing these steps today, and watch your advisory practice grow through targeted, organic local leads.

FAQs

1. Does SEO work for financial advisors?

2. Is doing local SEO worth it?

3. What is the 80/20 rule for financial advisors?

4. Can you make $300K as a financial advisor?

Yes, making $300K as a financial advisor is definitely achievable. According to CareerEmployer, advisors with seven to ten years of experience can exceed $300,000 per year.